Public school supporters would like to see cost of voucher schools itemized on tax bills

This year's tax bill will reveal to Green Bay residents how much of their money goes to voucher schools. But other districts still keep that information from taxpayers.

While other school districts continue to advocate for voucher transparency on taxpayers’ property tax bills, Green Bay has finally decided to do just that.

Green Bay residents will see a line item in the "Note" section of their 2025 tax bills stating the specific dollar amount levied for private school vouchers (around $10 million for the 2025 statements).

Public school advocates think taxpayers have a right to know just how much of their taxes are going to fund voucher program schools.

For residents in the Appleton Area School District, about 11% of the school tax levy funds private school vouchers. That’s roughly $9 million annually.

Combined, $22.5 million was diverted last year from the Appleton, Menasha, Neenah, and Oshkosh districts and sent to private schools.

The Ashland School District, where more than $870,000 taxpayer dollars went to private schools, recently passed a resolution asking the city to add similar information to its tax bills. Milwaukee and Racine already provide an insert of voucher costs in with their property tax bill.

In September, Sen. Kristin Dassler-Alfheim (D-Appleton) and Representative Lee Snodgrass (D-Appleton), along with other legislative Democrats, introduced the “Kids First” bill package to address key issues in public school funding, including a voucher transparency bill.

LRB-4318 requires property tax bills to include a line item that shows the taxpayer cost of vouchers. Currently, property tax bills are required to list only the amount going toward K-12 schools, without revealing what portion also goes toward private schools.

“The people of Wisconsin deserve to know just how much of their tax dollars are going to private schools. We already have the cost of public schools on property tax bills,” Dassler-Alfheim said. “All this does is apply this measure of accountability to private schools as well. Most people have no idea how much is coming out of their taxes and going to private schools, and that’s a problem.”

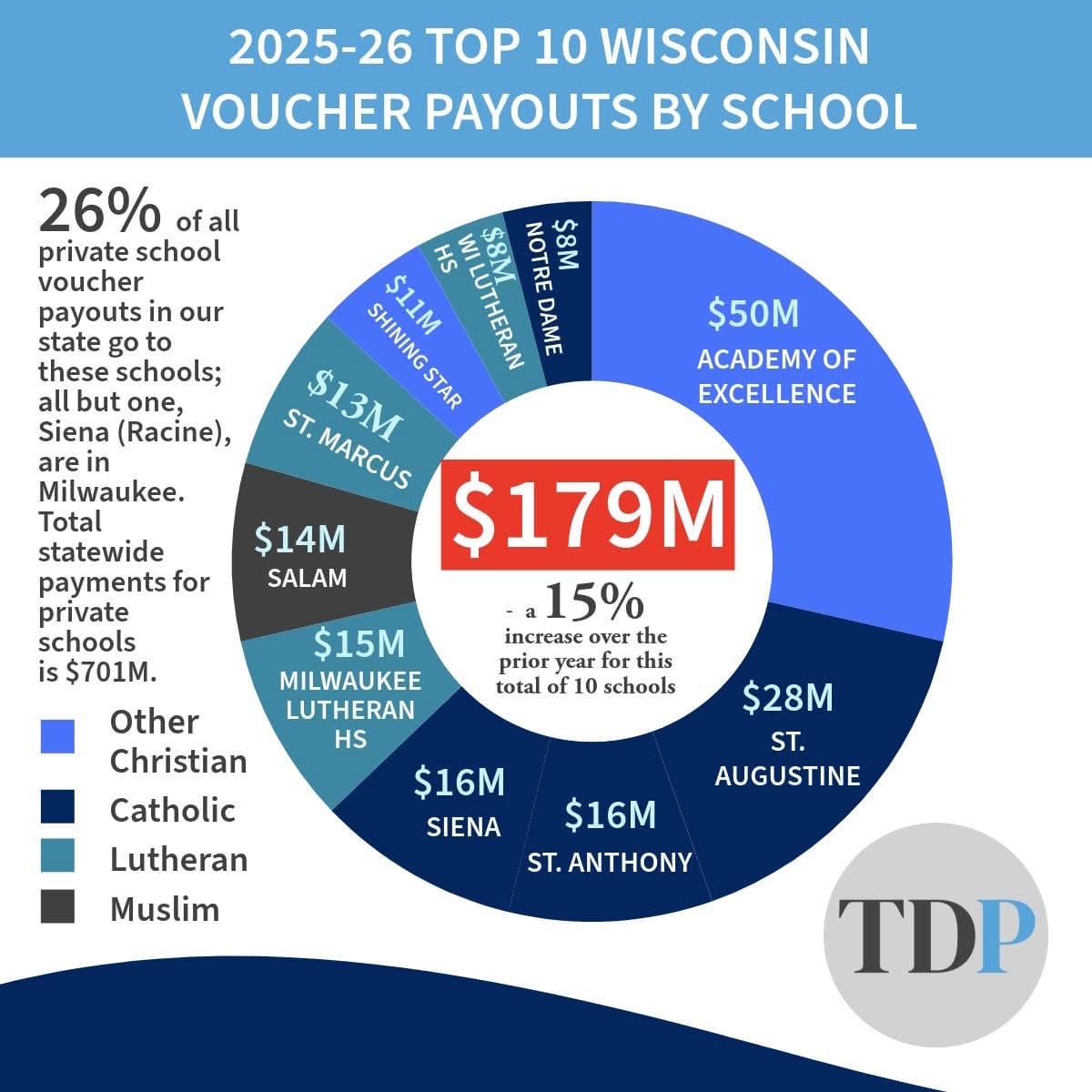

The total taxes dedicated to the four school choice programs this school year is $701 million. Public school advocates point to a variety of disparities between voucher and public schools. Voucher per-student funding ranges from $10k to $13k, often exceeding the revenue limit for public school students. Private school voucher payouts increased by 11% this year, while public schools received no increase. They further point out that funding for public school students has lagged inflation for nearly 18 years, with the lost revenue per-student over that time amounting to more than $3,000.

Advocates also argue that voucher schools are not bound by many of the same rules governing public schools, including graduation standards, testing requirements, school report cards, and teacher certification. Private schools do not have to accept all students, provide due process, or adhere to federal nondiscrimination laws. Locally elected school boards do not govern them, and they are not bound by open-meetings and public-records laws. In the absence of public oversight, public education proponents argue, the public is not assured that their money is being spent wisely.

The Wisconsin Public Education Network (WPEN) has created a resource hub to move toward “transparency and accountability for all schools that receive public money”. A tool on the WPEN website shows how much public school funding was redirected to private schools by district for the 2024-25 school year. The totals for the 2025-26 school year will be greater by about 11%.

A voucher transparency bill has been introduced at least since 2017.

Public school supporters would like to see cost of voucher schools itemized on tax bills © 2025 by Carol Lenz is licensed under CC BY-NC-ND 4.0