Critical professions at risk after new federal rules limit loans for advanced degrees nationwide

Federal borrowing limits for graduate students now depend on whether their program is designated a 'professional degree.' Students in approved fields can borrow up to $50,500 per year with a $200,000 lifetime maximum. All other graduate students face a cap of $20,500 annually and $100,000 total.

Marion Sterk-Ciresi adjusts her stethoscope in UW–Madison’s nursing simulation lab. A senior preparing to graduate, she had planned to pursue a master’s degree and eventually teach. Now, newly imposed federal loan limits are forcing her — and thousands of students across the country — to reconsider whether advanced study is financially possible.

“It feels like a slap in the face,” she says. “It’s undermining the profession at a time when we need it most.”

Her frustration is widely shared. New federal loan rules are reshaping graduate education, with sweeping consequences for nursing, physical therapy, and other fields that rely on advanced training. In Wisconsin — where officials project a shortage of up to 19,000 nurses by 2040 — the stakes are especially high.

Redefining What Counts as a “Professional Degree”

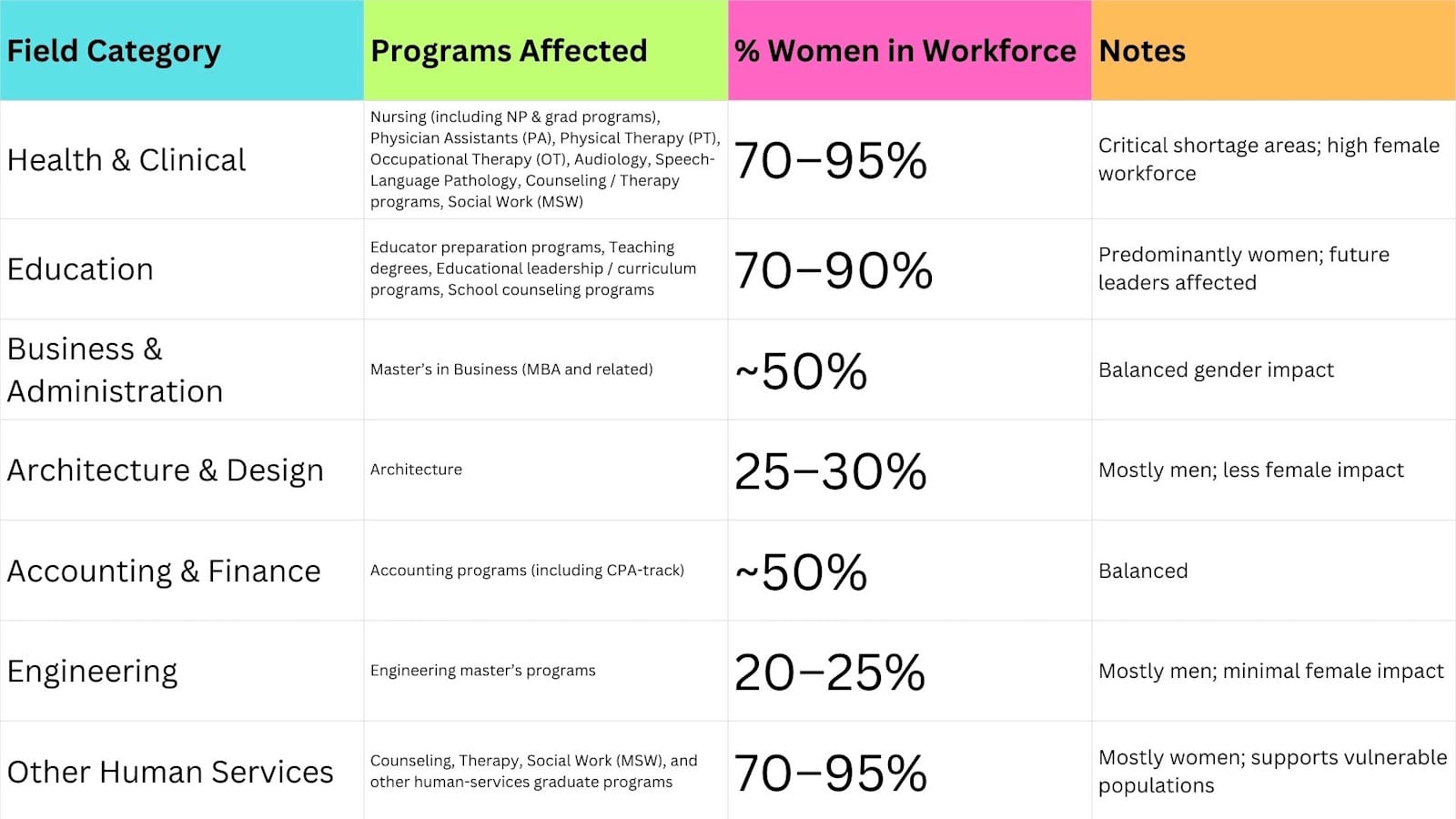

Under the Trump administration’s One Big Beautiful Bill Act, federal borrowing limits for graduate students now depend on whether their program is designated a “professional degree.” Students in approved fields can borrow up to $50,500 per year with a $200,000 lifetime maximum. All other graduate students face a cap of $20,500 annually and $100,000 total.

In November, a Department of Education rulemaking committee recommended adopting an existing federal list of recognized professional fields — including medicine, law, pharmacy, and dentistry. Notably absent were nursing and many physical therapy programs.

Although nursing has never been included on the federal professional degree list, the new, narrower definition creates fresh barriers for students pursuing advanced roles. Tuition for graduate nursing programs in Wisconsin can approach $100,000 before accounting for clinical fees, textbooks, housing, and transportation. Doctor of Physical Therapy programs may exceed $100,000 as well — far above the $20,500 annual cap for non-“professional” programs. Students aspiring to become nurse practitioners, clinical specialists, educators, or physical therapists now face a sharply reduced — and often insufficient — pool of federal aid.

Kelly L. Huenink, MSN, Certified Family Nurse Practitioner and Advanced Practice Nurse Prescriber, underscores the stakes:

“For nurses pursuing advanced degrees, the new loan limits create a real barrier. Most graduate nursing programs already exceed the $20,500 yearly cap, so students will be forced to take on higher-interest private loans—or walk away from the nursing/healthcare degree altogether. Unpaid clinicals are required for training, so students often work part-time as student clinicians, making it difficult to earn money while attending school. In the long run, this will affect patient care.

“Advanced practice nurses and RNs play a major role in primary care access, chronic disease management, and rural health. If fewer nurses can afford to advance, we’ll see fewer clinical leaders and fewer providers at a time when demand is rising.”

Students and Educators Warn of Far-Reaching Consequences

Students and professional organizations warn that the policy’s effects will cascade across the labor market and into communities.

Sterk-Ciresi’s classmate, Libby Pleva, fears the new borrowing limits will deepen longstanding inequities.

“Rural and underserved communities already struggle to attract providers,” she says. “If fewer students can afford graduate school, those gaps will only widen.”

Huenink says students from working-class backgrounds will suffer the most.

“Many of us don’t have family resources to fall back on, and nursing is still a predominantly female profession,” she insists. “These limits could widen inequities by making leadership and advanced practice roles accessible mainly to those who can self-fund.”

Debra Barksdale, president of the American Academy of Nursing, emphasizes the national significance:

“The need for master’s- and doctorally prepared nurses continues to grow across clinical, educational, and leadership roles. Reducing federal borrowing power risks constraining that pipeline at a time when the nation cannot afford to lose it.”

Huenink adds that the new provisions creates an additional financial barrier for women seeking to advance into higher-paying, provider and leadership roles, something desperately needed.

“It doesn’t make sense to classify nursing as ‘non-professional’ when NPs provide high-level clinical care and fill critical workforce shortages,” she says. “These policy changes risk pushing future nurses out of the pipeline right when the health system needs them most as leaders and educators. Because nursing and many other ‘non-professional’ classified degrees are overwhelmingly pursued by women, these loan limits effectively penalize female students.”

A Shrinking Pipeline Amid Growing Need

The consequences extend far beyond hospital staffing. Elder abuse — which advocates warn may become one of the defining crimes of the 21st century — is projected to rise as the population ages. By 2060, nearly 96 million Americans will be 65 or older, sharply increasing demand for long-term and community-based care.

Chronic understaffing already leaves caregivers overstretched, heightening the risks of neglect, medication errors, and preventable harm. Older adults with cognitive impairments who are unable to advocate for themselves are especially vulnerable.

Advanced nursing roles, including geriatric specialists, nurse practitioners, and nurse educators, as well as physical therapists, are essential to maintaining care quality and preparing the workforce that protects these residents. Lower loan limits threaten to constrict this pipeline just as Wisconsin’s healthcare system faces mounting strain.

Beyond Nursing and Physical Therapy: Equity and Access

Because borrowing capacity directly shapes who can pursue advanced credentials, the policy risks narrowing pathways into leadership, administrative, and specialty roles for students in critical fields.

For students from low- and middle-income families, the financial barrier is particularly severe. Wisconsin’s state-based incentives — such as loan forgiveness for nurse educators — offer meaningful support but cannot fully offset reduced federal borrowing power. Huenink cautions that the broader effect could be systemic.

“Project 2025 indirectly risks making the workforce harder — and less fair — for many women,” she asserts. “By dismantling nondiscrimination protections, undercutting workplace safeguards, removing social supports, and promoting a societal vision rooted in traditional gender roles, the policy creates conditions where women may face greater barriers to hiring, advancement, pay equity, and safety.”

Conclusion: More Than a Bureaucratic Change

For students like Sterk-Ciresi, the implications are immediate and deeply personal:

“I want to teach, to lead, to give back,” she says. “But now I’m not sure I can afford to continue my education.”

This policy is far more than an administrative adjustment. By redefining which careers qualify for higher federal loan limits, the Department of Education is shaping who can pursue advanced training — and ultimately, who will staff and lead the professions that communities depend on.

As students navigate the new constraints, the effects will likely ripple through classrooms, clinics, counseling centers, and eldercare facilities, potentially reshaping the workforce that cares for the public and protects the most vulnerable.

Critical professions at risk after new federal rules limit loans for advanced degrees nationwide © 2025 by Jean Kiernan Detjen is licensed under CC BY-NC-ND 4.0