ACA saved her during crisis but Appleton woman fears what end to enhanced subsidies will mean

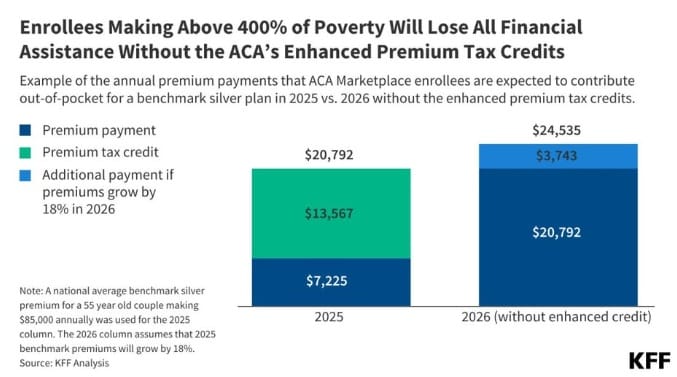

Their expiration, according to the Kaiser Family Foundation will on average more than double the premiums of Americans who purchase off the ACA marketplace

Robin Fischer’s story is one of tragedy and trauma, of sudden death and upheaval.

It is also a story about how the Affordable Care Act helped her family navigate some of the disruption that followed by buffering her against even more trauma: economic uncertainty.

What Fischer does not want it to be is “a poor widow story.”

Given the circumstances, it sure might have been. But Fischer hardly seems inclined to victimhood or passivity. This is a woman, after all, who opted to switch careers in her mid-forties after teaching school for two decades, who went back to school to earn a master's in counseling and begin a career in mental health.

Fischer was able to change directions in her life only because her husband, Korey, had good insurance through his employer. So her story is also one that sheds light on just how large a role health insurance plays in the options available to many Americans. It is something called “job lock.” One in six Americans is unable to switch careers because they are dependent on employer health insurance. Among low-income workers that number is more than one in four. People are often anchored to their health plans.

“I was able to make that change because our daughter and I could go on my husband's insurance,” she says. “It allowed me the freedom to begin my own small business.”

And so, after a brief stint on the non-profit side of the mental health profession, Fischer decided to open her own business, partnering with another therapist to open the Creative Counseling Center.

‘The ACA had our back’

Five months after she started that business, Korey died suddenly. Grief and shock did not offer a grace period for the tough decisions she faced.

“I'm looking at being the sole provider for myself and my daughter,” Fischer says. “She's 12 years old. And so the things on my mind were, of course, day-to-day expenses and her college and then, it’s like, what's going to happen with her health care? I was pretty scared.”

She used her allotted year of COBRA insurance offered by her husband’s employer but once that expired, Fischer went shopping on the Affordable Care Act marketplace. The ACA, which passed in 2010, provides subsidies to people who do not have employer insurance and who make less than 400% of the Federal Poverty Level. Those subsidies either help pay their monthly premiums or reduce deductibles and co-pays on the back end. Nearly 24 million Americans use the ACA for their health insurance.

“As a small business owner, I would not have been able to afford health insurance without the subsidies the ACA provides,” she says. “The ACA really had our back.”

For Fischer, insurance was not just a buffer against future risk, it was an immediate need. Because Korey died in the house and because their daughter, Rachel, witnessed Robin’s attempts to save him, both mother and daughter sought therapy to deal with the trauma. Later, the ACA would help both deal with surgeries – one for a knee, another for a hip – as well as post-op physical therapy.

And because the ACA prohibits insurance companies from denying coverage for pre-existing conditions all of that was covered.

Fischer was able to obtain an ACA plan through Network Health of Menasha for around $640 a month for herself and her daughter. Just as important were the reasonable annual deductibles of $1,500 and preventative care that was covered at anywhere from 80 to 100 percent.

‘Premium spikes imminent’

But starting in January, with the end of the Covid-era enhanced subsidies that not only helped further lower the premiums of low-income households but also capped premiums for higher earners (above the 400% federal poverty level) at 8.5% of household income, Fischer is looking at a potential doubling of her monthly premiums.

Given that, eight years into her business, she has developed a solid clientele and is doing relatively well financially, Fischer is not suggesting the sky is falling for her and her daughter, who is now at college. But there will be an impact. She says she would have liked to have waited until 2026 to see if she needed surgery for an issue that seemed to be getting better. But she says she couldn't risk it, given the uncertainty of what her coverage might be next year.

Beyond that, she says, she’ll have to make sacrifices. Those new premiums will likely add up to an additional $8,000 annually.

“As a small business owner, I'm paying $16,000 a year in (federal and state) taxes and now throw on top of that another eight thousand for healthcare,” she says. “What I'm going to be thinking about now is really slimming things down, because I'm a pretty smart financial person and I make sure I max out my Roth. I max out my Health Savings Account.

“But with all those kinds of things that I do, I'm going to have to be looking at how do I continue to invest in my future, continue to reduce my taxable income and come up with this extra money. Do I work more, which will throw me up in a higher tax bracket and probably increase my premium even more for health care? What do I cut? I am lucky. At least my business is thriving, and I have a steady stream of income, but there are plenty of people who don't have those options.”

‘The Republicans have no plan …’

The enhanced subsidies, which were rolled out in President Biden’s American Rescue Plan Act during the pandemic, are set to expire in 2026. Their expiration, according to the Kaiser Family Foundation (KFF), an independent, national nonprofit organization focused on health policy research, will on average more than double the premiums of Americans who purchase off the ACA marketplace.

Not only that, it will eliminate the protection against the so-called income cliff that hit people whose income was beyond the 400% federal poverty level for qualifying for ACA subsidies. With those enhanced subsidies, for example, a couple making $82,000 a year (which is above the 400% threshold) had their premiums lowered significantly. If they are eliminated, KFF says the potential annual increase in their premiums could surpass $22,000.

During the negotiations to keep the government open in October, Democrats held out for an extension of the enhanced subsidies for one year, but Republicans wouldn’t budge. After a three-week government shutdown, Democrats gave up the fight and the government reopened.

President Trump, who has promised but never offered an alternative to the now popular Affordable Care Act, recently floated the idea of extending the enhanced subsidies for as much as two years as Americans begin to realize just how much their premiums could rise. But most Republicans in Congress are adamantly opposed.

“So all politics aside, the Republicans have no plan.,” she says. “If they had a plan, we would have seen it 11 years ago when Trump said he’d have one ready to go in two weeks.”

‘Are they helping me? No’

As a business owner who relies on her patient’s insurance for income, the change back to the 400% threshold could cut both ways for Fischer.

“I don't know what's going to happen,” she says. “Like, how this is going to affect the healthcare industry as a whole. I do have a small handful of people who are ACA subscribers who I would imagine we'll have to come up with some kind of a plan to keep seeing them.”

Fischer, who is a big fan of the ACA but understands not just how precarious private insurance is for the insured and also what it’s like to deal with corporate insurance companies from the billing end, says Medicaid is far superior. She says she knows how to deal with the intricacies and arcana of an insurance claim but points out she only has a couple dozen claims a week. She says she can’t imagine dealing with the thousands of claims the big clinics and hospitals see every day.

“And then I see Medicaid patients,” she says. “It’s the most consistent, simplest system. You get one flat rate. It's just so much more dependable than when you look at all the commercial insurance. They pay different amounts for the same treatment, the same procedure. Why?

“If all of us had unlimited access to the kinds of therapies that we needed to be well, we would be a thriving community,” she adds. “I see patients who drag themselves to work every day to demanding jobs, but who can't get the care they need to take care of their bodies. It's sad and frustrating that I can't do more for them.”

When Fischer says she doesn’t want this to be a poor widow story she’s referring to how little support people who struggle through hardship receive from the politicians who tell people to “pick themselves up by their bootstraps.

“‘Poor, poor widow trying to feed her child and keep her business afloat and send her child to college,’” she says. “But when you think about it from a woman's perspective, it’s damned if you do and damned if you don't. I'm choosing not to be the poor widow, right? I'm choosing to be what the Republicans say they want. Getting out there and working when I could probably go on Medicaid. But are they helping me to do that? No. They're punishing me for doing that.”

ACA saved her during crisis but Appleton woman fears what end to enhanced subsidies will mean © 2025 by Kelly Fenton is licensed under CC BY-NC-ND 4.0